“Mastering Hurst Cycle Analysis.”

JM Hurst was an American engineer who, in the 1970s, was the first researcher to use the modern computer’s power to investigate financial market cycles. JM Hurst is widely recognized today as the ‘father’ of modern cyclic analysis.

After a 25-year career in aerospace engineering, Hurst published a book in the early 1970′s called “The Profit Magic of Stock Transaction Timing,” and then followed that with the publication of his course called the Cyclitec Cycles Course, also known as “JM Hurst’s Cycles Course.” Analyzing a market, according to Hurst Cycles, is a combination of science and art, and it is a skill that must be learned.

Chapter 1:

The longer the time between adjacent lows of a cycle, the further it tends to rise and fall.

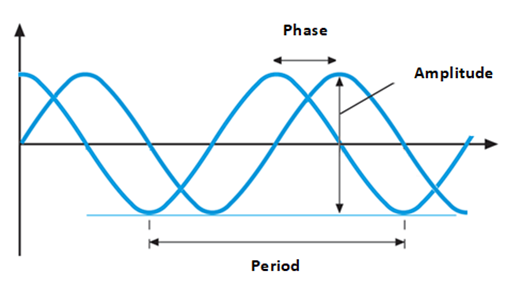

Amplitude: The height of a cycle

A complete cycle describes a path through time from a trough to a peak and then back again to the level of the previous trough.

- In Physics, a cycle is defined as a repeating fluctuation of an observed variable, described by a sine wave around a central value. Amplitude is the absolute difference between the central value and the peak or trough.

- In Financial Markets, the observed variable is price, and the central value is the long-term average price. In other words, price tends to fluctuate rhythmically around a mean.

Amplitude is defined as the distance between the two extremes, trough, and peak.

Velocity (speed) and Acceleration

The amplitude of a cycle is a measure of its size or power; in the market, it is represented by the price change.

| Cycle at extremes (Trough / Peak) | Cycle at halfway | |

| Velocity (Speed) | Minimum or Zero | Maximum |

| Acceleration | Maximum | Minimum |

Period: The time after which the pattern of a cycle starts repeating itself is the length or period of the cycle. This is the distance between the two adjacent troughs.

- Frequency: of a cycle is the reciprocal of the period and shows how many times it fluctuates in a given time. In physics, the convention is to describe cycles in terms of frequency, and the measurement is hertz.

- In Market analysis, if the cycle period is short, the frequency is high. If the cycle period is long, then the frequency is low.

Phase: It’s the time shift between two cycles that have the same period but are peaking at different times

- In physics, if two cycles have a constant phase difference, they have the same frequency and are said to be coherent; coherence is a measure of cycle correlation.

- When the Phase is known, we can say how far along its path is at any given time.

- This value can be used to estimate when a cycle will reverse or compare the progress of one cycle to that of another.

Principle of Proportionality

- With the exception of very long cycles, amplitude and period tend to be proportional; for example, an 80-day cycle has amplitude around double of the 40-day cycle, i.e., the price can move twice as much as in shorter cycles.

- The acceleration of a true cycle is always towards the center of its oscillation; in other words, it reverts to the mean.

Principle of Summation

- The value of a short cycle at any given time is summed with that of a long cycle, which in turn is summed with an even longer cycle and so on to the upper limit; what we perceive as price movement is simply all of these cycles added together.

- The more substantial the TREND component, the less visible/apparent the cycles’ fluctuations.

Principle of Cyclicality

A set of principles that governs cycles.

(1) Harmonicity: cycles tend to be related to one another by multiples of two (sometimes multiples of three).

- Multiples of Two: any given cycle tends to be half as long as its closest longer neighbor and twice as long as its nearest shorter neighbor.

- The 80-day cycle breaks down into two 40-day cycles, which in turn, breaks down into two 20-day cycles each, and vice versa.

- Usefulness: This makes the job of searching cycles much more straightforward; if you have found one, you should be able to find the others.

- Multiples of Three: this is the exception,

- The 54-month cycle breaks down into three 18-month cycles.

- 54-year cycle (Kondratieff wave) breaks down into three 18-year cycles.

(2) Synchronicity: cycle lows tend to converge; in other words, the troughs of the long cycle will coincide with the troughs of all shorter component cycles. However, apart from commodities, this is not the case for cycle peaks, which tend to be more dispersed.

This is why the convention of measuring cycle period is from low to low.

- What does it mean? The time location of an 80-week low will be the same as that of a 40-week low, a 20-week low, a 10-week low, and so on.

- What does it not mean? A short cycle low also implies the presence of a longer cycle low.

Usefulness: Once the long cycle period trough has been identified, we have immediately identified the time location of all shorter cycle troughs.

- Cycles transporting energy “Wave energy” is transferred from point to adjacent point, creating the illusion of forward movement, an example of a film creates the impression of continuity. In financial markets, the energy is not the price; instead, what moves the price, that is, the “Mood of the Market Participants,” fear, and greed. Hence the tops are round, while the bottoms are sharp.

(3) Nominality “Nominal Model”: there appears to be a specified set of individual cycles in the price history rather than an infinite number.

Calendar Days:

| Years | Months | Weeks | Days |

| 54 | |||

| 18 | |||

| 9 | |||

| 54 | |||

| 18 | 80 (560D) | ||

| 9 | 40 (280D) | ||

| 20 (140D) | |||

| 10 (70D) | 80 | ||

| 40 | |||

| 20 | |||

| 10 |

Trading Days (divide by 0.7):

| Years | Months | Weeks | Days |

| 54 | |||

| 18 | |||

| 9 | |||

| 54 | |||

| 18 | 80 (392D) | ||

| 9 | 40 (196D) | ||

| 20 (98D) | |||

| 10 (49D) | 56 | ||

| 28 | |||

| 14 | |||

| 7 |

(4) Variation: The deviation from the norm is expected: cycle periods and amplitudes vary over time.

(5) Commonality: These principles apply to all market cycles across the entire price history.

The word “Principle” in not referred to as law but rather “Strong Tendency.” Strong fundamental factors or price shocks will temporarily distort the picture. This is to be expected: forecasting the market is not an exact science.

Chapter 2

- Hurst’s insight was that trends are simply a derivative of the market cycle and that their direction, duration, and strength are, therefore, a function of underlying component cycles.

- One measure of trend strength is the price rate of change.

- Trendlines are arbitrary and what differentiates Valid Trendlines is that they are derived from specific cycles, and their construction follows particular rules, removing the need for subjective interpretation. i.e. they are valid representation of underlying cyclic action.

Valid Trendline (VTL) Rules

- A valid uptrend line connects two consecutive troughs of a specific cycle.

- A valid downtrend line connects two consecutive peaks of a specific cycle.

- If the VTL is crossed by prices between the two adjacent troughs or peaks, then the line is invalidated and cannot be used as VTL.

- For a downtrend line, the trough of a cycle longer than the cycle associated with the VTL must not fall between the two consecutive peaks.

- On the other hand, it is permitted for a peak of a cycle longer than the cycle associated with the VTL to occur between two consecutive lows.

Two Peaks lead to a Downtrend and Two Troughs lead to an Uptrend

The Key Role Played by VTL

- When the downtrend VTL is broken, the trough of the next longer cycle has passed.

- When the uptrend VTL is broken, the peak of the next longer cycle has passed.

- When prices break a VTL, the implication is that the longer cycle has turned. For a valid downtrend line, a break implies that the next longer cycle has turned up and that a trough of this cycle has passed.

- Furthermore, the reversal will have happened within the time span of the longer cycle period counting back from the break. i.e., So, for the 20-day down VTL, a break means the 40-day cycle trough is likely to have happened within 40 days back from the break.

- For a valid uptrend line, a break implies that the next longer cycle has turned down and that a peak of this cycle has passed.

- Furthermore, the reversal will have happened within the time span of the longer cycle period counting back from the break. i.e., So, for the 20-day up VTL, a break means the 40-day cycle peak is likely to have happened within 40 days back from the break.

Usefulness: The main job of the VTL is to confirm reversals in specific cycle components.

Chapter 3

Future Line of Demarcation (FLD): is a replica cycle displaced by a fixed amount to the right of an original cycle: in other words, the phase shifted forward in time. It is a duplicate cycle displaced to the right of the original.

Usefulness: The main role of the FLD is to forecast the extent of the potential price moves. In addition, it tells us the magnitude of the reversal we should expect: the higher the FLD, the more significant the reversal.

Also, because the price and the FLD move opposite to one another, when prices are advancing, we should expect to see the FLD declining, and when prices are falling, we expect to see the FLD rising.

The FLD number (FLDn) is half of the average period of the cycle of interest plus 1.

FLDn = (P / 2) + 1, where P is the cycle period.

- When the trend acts in the same direction as the projection, i.e., working with it, the achieved price will overshoot the target price.

- When the trend acts opposite to the projection, i.e., working against it, the achieved price will fall short of the target price.

| Projection | Underlying trend | Result | Price vs. Target | Trade profit |

| Downside | Down | Overshoot | Lower | Better Short |

| Upside | Down | Undershoot | Lower | Worse Long |

| Downside | Up | Undershoot | Higher | Worse Short |

| Upside | Up | Overshoot | Higher | Better Long |

There are many FLD patterns and the two most important are the cascade and the pause zone.

- Cascade: it’s ideal when prices are either advancing or declining steeply, and FLDs are tightly stacked, evenly spaced, and running parallel in the same direction.

- When prices rise steeply, FLDs will generally be arrayed below prices and will also rise steeply: in this environment, you should be looking for an imminent and sharp sell-off.

- When prices fall steeply, FLDs will generally be arrayed above prices and will also fall steeply: in this environment, you should be looking for an imminent and sharp rally.

- The tighter the FLD stack and steeper the price move, the more powerful the signal and the more explosive the subsequent price move out.

- Pause Zone: this is where having run freely for a while, the FLDs start crossing.

- When FLDs have been running in parallel and then start crossing each other, then at that future time, you should be looking for a consolidation rally or decline, or else an area of congestion; in other words, it is likely to stop prices temporarily.

- If the FLD stack is shallow, or if they wander about crisscrossing each other and unevenly spaced, the move-out has less conviction.

Chapter 4

Phasing Analysis:

- This is a method of isolating and then marking the time location of each component cycle trough in the composite data.

- This process provides us with the information required to calculate the average length of each cycle and tells us how far along they are at the end of the data.

Note: the convention is to measure the period between troughs rather than peaks due to the “Principle of Synchronicity.”

Cycle Envelops:

Are sets of moving average “MA” bands calibrated to the dominant fluctuation of the prices on the chart and set to enclose most of the price movement? Also called “Hurst’s Dominancy Envelope.”

- Centering the Moving Average: The conventional Technical Analysis line up the last value of the MA with the last signal, i.e., pushing it artificially forward.

- Centering the Moving Average places the MA value in the middle of the subset of data that is being averaged, i.e., there will be a lag of half of the MA period; if its a 15-day MA, then the MA value will stop seven days before.

- It accurately traces out the path of the cycle, more or less precisely picking out the time location of the peaks and troughs as the centered MA runs up and down the middle of the price action.

- Conventional MA is for crossover systems, while the centered MA is in phase with the cycle.

- The excursion is the moving average value subtracted from the close. By plotting the path of the excursions, we can see the shorter cycles the moving average has left behind; Hurst called this the “Inverse Moving Average.”

Note: as we are using the centered moving averages, the MA value needs to be subtracted from the price in the middle of the data being averaged rather than the last data. Otherwise, the output will be distorted. I.e., if we use a 14-day centered MA, then the Inverse Moving Average will be the MA subtracted from the close seven bars previously. This is plotted in a Histogram.

- Bandwidth: gauging the bandwidth by eye might be more of a hit-and-miss; better to measure the amplitude of the major swings against the y-axis and then halve the figure to set the bands. You can code it by calculating the maximum deviation within the high-low range and then adding and subtracting from a centered MA.

- MA Period: there are no complex and faster rules about setting the MA periods, but as a rule of thumb, between one-quarter and half the length of the dominant cycle tends to work well.

Note: Too long, and the MA won’t pick out reversals; too short, it will show every twist and turn.

Phasing Analysis Set-Up:

| Analysis Timeframe | Arithmetic Scale | 300 bars is usually the upper limit for Hurst analysis and semi-log data should be used for very long time frame |

| Amount of Data | Start with 300 bars then scale it down to 200-250 bars, Hurst rule of thumb was: the chart should display at least one and a half turns of the dominant cycle. | |

| Choosing a start date | The exact date is not that important but it helps if you use the obvious low. | |

| Diamonds Grid | Separate rows per cycle | |

| Use Diamond shapes | ||

| First attempt: use black then different colors for each cycle. | ||

| Measuring Cycle Periods | Original Method, using your hand!! | |

| Movable Horizontal Line |

Thomas Edison: “Opportunity is missed by most people because it is dressed in overalls and looks like work.”

Chapter 5

Spectral Analysis:

- Periodogram: this is the output of a mathematical operation called spectral analysis, which is the process of finding the frequency components of a signal by defining its cycles in terms of sine and cosine functions.

- In theory, the purpose of the Periodogram is to aid phasing analysis.

- Spectral Analysis can be applied to financial markets. However, the truth is that the Periodogram does not test very well on actual market data.

- Discrete Fourier Transform (DFT), is the next generation of the Periodogram, done by John Ehler,

- DFT does not attempt to identify all of the cycles in the data, but only highlights the dominant trading cycle.

- DFT ignores all cycles above 50, assuming it is a trend and not a cycle, in contrast to Hurst, which considers long-term as well, and 50 as simply part of a bigger cycle, not a trend.

- Peak Translation:

- Right translation: the peak is pushed towards the right, and it is caused by an underlying uptrend.

- Left translation: Peaks are displaced to the left-center as caused by the underlying downtrend.

Chapter 6:

- We need accurate VTLs to help us pick out turns in the cycles, and the primary purpose of the FLDs is to project prices.

- Liquidity is obviously an important primary filter, but equally important is relative volatility.

- Hurst trading is a short to intermediate-term methodology with a strong bias towards playing reversals; the focus tends to be on securities that offer the largest percentage gain in the shortest possible time.

- Trade Risk: this is a function of how quickly you enter a trade after a reversal, and you will see that often it is better to wait rather than act immediately.

- The more active a security is, the faster you make trading profits. And the faster you make trading profits, the sooner you can redeploy your capital.

Creating a Shortlist:

Pre-conditions: some traders look at overbought or oversold stocks with divergence patterns, reasoning that they are ready for a reversal.

Hurst Analysis filters:

- Volatility and Cyclicality: To be of interest an issue needs to fluctuate enough to make it a worthwhile trading vehicle, and the cycles need to be readable.

- Trading reversals versus long-term investing: Hurst analysis is primarily a trading methodology, and the best performance results are to be had in short to intermediate timeframes, i.e., six weeks to three months; for this reason, the 18-month cycle is usually the longest you will need to analyze, another longer is simply trend.

Cycle analysis is mainly about trading out of reversals, in other words, waiting to enter a trade when there is enough evidence to suggest that a reversal significant to your particular timeframe has just occurred.

- Volatility Index (VI): this is a measure of a security’s volatility relative to that of the overall market and, as such, allows comparisons between issues to be made. The higher the VI, the more active the issue is compared to the market and the more attractive it is as a trading vehicle.

In Hurst’s original work, the lookback period over which the Volatility Index was calculated is equal to the dominant cycle; having said that, as we are going to use this for a quick filter, a fixed lookback setting is acceptable.

ABS [ (H(0) + L(0)) / 2 – ( H(1) + L(1)) / 2 ] / [ (H(1) + L(1)) / 2 ] * 100

The Average Percentage Change for a security over period is calculated (VOLSec)

VOLSec = ∑CSec / n

- Average True Range (ATR): it is the next generation of volatility measure produced by Welles Wilde

Formula:

TR = max [(high−low), ABS (high – close previous), ABS (low− close previous)]

ATR= ∑TRi / n

where:

TRi=a particular true range; and

n=the time period employed (which is usually 14 days).

- Relative Volatility: VI / ATR calculation of a security needs to be divided by the ATR of an index to convert it to relative value.

A final adjustment needs to be made to ATR as the True Range is expressed in price, and we need to convert it to % similar to Hurt’s VI; this is done by dividing it over the Simple Moving Average.

RV = [ ATRSec(14) / SMASec(14) ] / [ ATRInd(14) / SMAInd(14) ]

- Limitation: Volatility is backward-looking, and also, in absolute terms, low volatility is often a lead indicator of high volatility, and it is not uncommon for a security that has been languishing in a narrow range to break out explosively.

Scanning Charts:

- Scanning Charts:

Initial Scan – Weekly Chart:

- What is the estimated period of the longest obvious cycle?

- What roughly is its amplitude?

- Is the trend underlying the longest cycle up or down?

- What is the estimate of the next shorter cycle?

- What roughly is the amplitude in percentage terms of this shorter cycle?

- Has there been or is there likely to be soon a reversal in either the longest cycle or the next shorter cycle?

- Roughly what is the status of these cycles?

Step 1: Estimating cycle periods

- Readability of the chart

- Identifying the longest cycle

- Identifying the shorter cycles

- Tools that need to be used: Spreadsheet to keep track of everything, and DFT check if required, but it is too long and not that useful

Step 2: Estimating cycle amplitudes

- Measure the difference in price between the start of each cycle and its end, starting with longer cycles toward the end.

- Volatility and amplitude, the bigger the volatility and the larger the amplitude gives a better opportunity to trade.

Step 3: Estimating underlying trend

- Using FLD projections: when the underlying trend is in the same direction as the projection, the target tends to overshoot, and when the underlying trend is in the opposite direction to the projection, the target undershoots, we can reverse engineer to provide insight about the trend direction.

- Open or inactive: if the FLD projection has been made, but the target has not yet been met, then the projection remains open; conversely, if an FLD projection has been made and the target has been met, then the projection is inactive.

If you are looking to go long, but there is a big downside projection still open, then you need to either resolve any conflicts in the analysis or wait before taking action.

Normally, an FLD projection is neutralized or rendered inactive when prices eventually cross through it in the opposite direction, or there is an appropriate VTL break pointing to a reversal.

- Using historical FLDs: to gauge the underlying trend, we need to see how price cycles and FLDs have interacted over the whole chart.

Final Scan – Weekly chart:

Using the three tools to conclude whether to trade or wait (long or short)

- Rough phasing analysis.

- VLTs.

- FLDs.

Check the chapter for more details of how to enter a deal.

Good luck!